Degree:

Masters in Business Administration

Degree:

Masters in Business Administration

Specialisation:

Financial Technology

Specialisation:

Financial Technology

Duration:

2 years Full-Time

Duration:

2 years Full-Time

Campus:

Ajeenkya DY Patil University, Pune, India

Campus:

Ajeenkya DY Patil University, Pune, India

Each 15-weeks module is worth 4 credits, as per NHEQF requirements; Dissertation module carries 8 credits, while Professional Development will carry 3 credits per each term it is delivered.

| Semester | Module Title |

| 1 | Ethics and Corporate Governance |

| Principles of Finance and Banking | |

| Managerial Economics with introduction to strategy | |

| Financial Modelling | |

| Personal & Professional Development |

| Semester | Module Title |

| 2 | Risk Management |

| Private Equity, Venture Capital & Valuation of Companies | |

| FinTech Business Model | |

| Data Analytics & Machine Learning in Finance | |

| Professional Development |

| Semester | Module Title |

| 3 | Behavioural Finance |

| Python Programming | |

| Cryptocurrencies: from Blockchain to stable coins | |

| Security Analysis | |

| Professional & Personal Development |

| Semester | Module Title |

| 4 | Dissertation |

| Regulatory Trends in Fintech: decentralised finance and Govcoins | |

|

Choice of one elective from a list below:

1. Game Theory

2. Derivatives

3. Insurance

4. Islamic Finance |

The internship that follows Year 1 allows students to apply their knowledge in a commercial context. Before interning, students will take a "Finance Professional" course at the university that covers workplace behaviour, group work (Tuckman, Belbin), and reflective learning (the Kolb Learning Cycle). After the internship, students will write a reflection essay summarising their experience and tying it to previously learned frameworks.

Founded with the goal of equipping the next generation of students to seize the many possibilities at the crossroads of management, pure science, and technology, ADYPU Nuovos has been a driving force in this endeavour from its inception. We think India is on the threshold of unleashing massive growth in new industries such as finance, space technology, and health, etc., as an increasing number of businesses and decision-making processes rely on Web 3.0 and computer-based technologies, especially in Fintech.

The MBA in Fintech curriculum is designed to consider knowledge and learning as a never-ending process of interaction between students and instructors that extends well beyond the lecture hall.

We appreciate that our students will start the program with different levels of understanding of the course materials and with a more or less mature approach to learning. We will help students tap into their prior knowledge, test it against what is presented in class, and use that knowledge as a base on which to build a better understanding of the world through the tools of economics and finance.

Our duty as educators and programme designers is to assist students thrive in higher education and beyond. Students in university classrooms are nearing their careers. To achieve, an individual must be quicker, smarter, more creative, and able to learn from failures. How can we prepare pupils for competition? Our strategy is to provide them with actual challenges that have various answers and demand cooperation and competitiveness. This helps students become critical thinkers and excellent problem solvers for their jobs. Case study-based education stimulates critical thinking and improves students' verbal and writing abilities, particularly the capacity to present and justify their point of view in front of peers.

MBA modules are made to encourage both analytical and critical thinking, as well as to be creative.

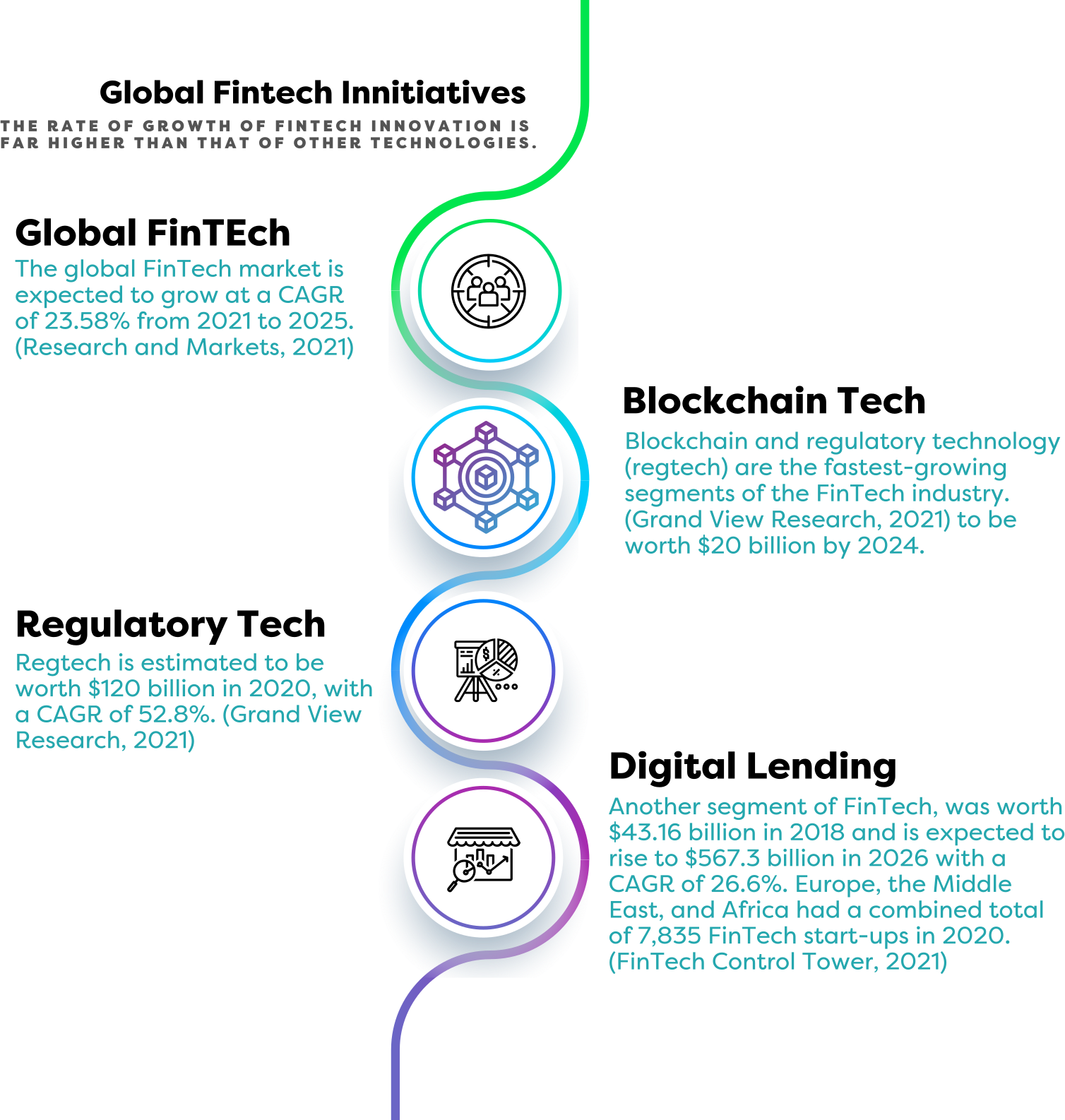

Innovative technologies like blockchain, artificial intelligence, cloud computing, the internet of things, and mobile computing are driving a massive revolution in the financial services business in response to increased demand in the worldwide FinTech market. There aren't enough workers in the financial services industry who have the right skills and know how to use new technology.

Over the next five years, India's FinTech sector is predicted to develop at a CAGR of 22%. Over ten thousand high-quality positions are available at various start-ups, making it the third-largest financial ecosystem in the world. As a country that has relied heavily on cash transactions, India is taking advantage of the emerging FinTech market. When compared to the worldwide average of 64%, India's Fintech adoption rate of 87% demonstrates the country's status as a leading hub for all things digital. Graduates and working professionals who lack a background in finance but are interested in the rapidly expanding and complex sector of financial technology might benefit from the MBA in FinTech.

Adopted by CRED’s banking expertise, I see the significance of Fintech in the financial industry and taking part in ADYPU’s MBA in Fintech program has me looking forward to learning more in-depth information. Fintech is an innovative way to manage the vast financial industry, offering blended skills in quantitative finance and computational technology.

BSc Physics (Honours, Ravenshaw University, Computer Application Training Center Post graduate certificate.)

Careers in Fintech: Capital Management Analysts, Risk Management Officers, Financial Compliance Managers, and More

Program Leader- Engineering

Dr. Vijayakumar Varadarajan is a devoted computer scientist and engineer with a Ph.D. and twenty years of experience at the national and international levels of education. His management expertise in a wide range of businesses and organisations has allowed him to get insight into the cutting edge of future advancements. Dr. Varadarajan can also develop, devise, and implement successful strategies to help a business reach its objectives. He thinks that for an organisation to grow and succeed, it needs to create a good environment where people from inside and outside can work together. On top of that, he’s the proud owner of nine separate patents. Dr. Varadarajan has earned several prizes and recognitions from various worldwide institutes and organisations for his excellent career. He’s been an Adjunct Professor at the University of New South Wales and a Professor and Associate Dean at VIT University in Chennai, to mention a few.

This is the only Fintech training program with a full-time degree that provides in-depth instruction in cutting-edge areas including APIs, blockchain, cloud computing, artificial intelligence (AI) or machine learning (ML), robotic process automation (RPA), the internet of things (IoT), and big data.

Stay updated on the latest Fintech industry trends and practises by accessing resources powered by our research, knowledge, and tech partners, such as TCS, JP Morgan, Bajaj Finance, Tech Mahindra and many more.

In order to make the most of your time spent studying about Fintech and advancing your career prospects, register for relevant networking events, job boards, Start-up brainstorming sessions, seminars, and webinars. Make contact with influential people in the fields of Financial Services and beyond. And be able to launch your ideas in real time

An MBA in Fintech is a specialized graduate degree program that focuses on the intersection of finance and technology. It equips students with the skills and knowledge needed to navigate the rapidly evolving fintech industry, including topics such as blockchain, artificial intelligence, and digital currencies.

This program offers students the opportunity to gain expertise in cutting-edge fintech topics such as blockchain, cryptocurrencies, and artificial intelligence, while also building a strong foundation in core business concepts. Graduates of this program are well-positioned to succeed in a variety of roles in the finance and technology industries, including consulting, entrepreneurship, and financial analysis with lucrative packages.

To pursue an MBA in Fintech at ADYPU, applicants should have 50% or above aggregate in all the Semesters / Years of undergraduate examinations and a reasonable quantitative background seeking a professional career in Fintech.

Additionally, candidates must submit a scorecard of any of the following tests:

Our MBA in Fintech program includes core business classes such as Principles of Finance and Banking, Managerial Economics, etc. while fintech courses include blockchain, cryptocurrencies, digital payments, and financial modeling. There are a few other courses that focus on important aspects of financial regulation, risk management, and data analytics.

The average salary for someone with an MBA in Fintech in India varies depending on several factors, such as the individual's level of experience, the specific job role, and the company they work for. However, according to PayScale, the average salary range for an MBA graduate in Fintech in India lies between 12 LPA to 35 LPA.

Graduates of an MBA in Fintech program have a wide range of career options available to them. Some popular paths include roles in investment banking, financial management, and consulting. Other opportunities may include entrepreneurship, digital marketing, and technology leadership positions within financial organizations. Capital Management Analysts, Risk Management Officers, and Financial Compliance Managers are a few career options to name.

MBA Pro is a global MBA designed for recent graduates and experienced professionals seeking international career advancement opportunities.

Just as the circulatory system is vital to the human body, the finance sector is the economy's lifeblood. Technology and innovation are the driving forces behind rapid advancements in finance.

Is rapid advancement giving you FOMO? Do you have thoughts about transitioning into a whole new field? Look no further because we got you!